Operation Choke Point

The Feds used the SVB bank run as an opportunity to seize Signature Bank, one of the last crypto-friendly banks in America. In response, Bitcoin did exactly what it was intended to do.

“You never let a serious crisis go to waste.” – Rahm Emanuel

When does a bank become ‘systemically important’ to the US financial system?

In 2008, the US government made the decision to ‘bail out’ the banking system after Lehman Brothers failed, triggering a panic that threatened to collapse the global economy. The US Treasury and Federal Reserve stepped in to bail out banks that were deemed ‘too big to fail’, such as JP Morgan and Bank of America which collectively held trillions of dollars in customer deposits.

Nearly fifteen years later, on the evening of 12 March 2023, the state of New York unexpectedly announced that it would shut down Signature Bank. Signature is a small regional bank that had less than $100 billion in customer deposits as of December 2022. Compare that to the overall size of the US banking system, which contains $23 trillion in customer deposits.

On 10 March 2023, the day that SVB stock crashed, Bitcoin (BTC) rallied +22% even as the broader regional banking ETF (NYSE: KRE) fell -22%. Source: Trading View

The decision was announced just before the Oscars in a joint statement from the Treasury Department, Federal Reserve and FDIC (emphasis mine):

“Today we are taking decisive actions to protect the U.S. economy by strengthening public confidence in our banking system. This step will ensure that the U.S. banking system continues to perform its vital roles of protecting deposits and providing access to credit to households and businesses in a manner that promotes strong and sustainable economic growth.

After receiving a recommendation from the boards of the FDIC and the Federal Reserve, and consulting with the President, Secretary Yellen approved actions enabling the FDIC to complete its resolution of Silicon Valley Bank, Santa Clara, California, in a manner that fully protects all depositors. Depositors will have access to all of their money starting Monday, March 13. No losses associated with the resolution of Silicon Valley Bank will be borne by the taxpayer.

We are also announcing a similar systemic risk exception for Signature Bank, New York, New York, which was closed today by its state chartering authority. All depositors of this institution will be made whole. As with the resolution of Silicon Valley Bank, no losses will be borne by the taxpayer.

Shareholders and certain unsecured debtholders will not be protected. Senior management has also been removed. Any losses to the Deposit Insurance Fund to support uninsured depositors will be recovered by a special assessment on banks, as required by law.”

Quick sidebar comment: That last sentence grabbed my attention. So the Feds have decided to hit every bank in America, even those with competent risk management programs, with a ‘special assessment’ to cover the losses of the banks that fail? This is the definition of “privatized profits and socialized losses”.

Also, the idea that those ‘special assessments’ will not be passed onto the customers of every bank in America through higher fees is laughable. Make no mistake, this will be a taxpayer-funded bailout.

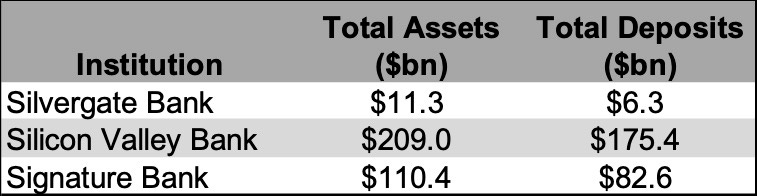

More importantly though, let’s examine the “systemic risk exception” that the Feds just decreed as their reason for shutting down Signature Bank. Here is a snapshot of customer deposits and assets for each of the three failed banks, as of 31 Dec 2022:

How is it possible that the Federal Reserve considers a bank that comprises less than 0.5% of the country’s total deposits to be “systemically important”? Either the Fed has very low confidence in the system that it is tasked to manage - not an unrealistic assumption, given how late they were to the game in raising rates to combat high inflation last year - or there were ulterior motives behind the Signature decision.

The confusion around Signature’s closure is compounded by a statement from one of the bank’s directors, one Barney Frank. It’s not just a bit ironic that the former Congressman’s name is on the Dodd-Frank legislation that has plagued the banking sector since the last financial crisis. Frank’s statement to CNBC on Monday was refreshingly and quite surprisingly candid:

On Friday, Signature Bank customers spooked by the sudden collapse of Silicon Valley Bank withdrew more than $10 billion in deposits, a board member told CNBC. “We had no indication of problems until we got a deposit run late Friday, which was purely contagion from SVB,” Frank told CNBC in a phone interview.

For his part, Frank, who helped draft the landmark Dodd-Frank Act after the 2008 financial crisis, said there was “no real objective reason” that Signature had to be seized. “I think part of what happened was that regulators wanted to send a very strong anti-crypto message,” Frank said. “We became the poster boy because there was no insolvency based on the fundamentals.”

Signature is no ordinary ‘Main Street’ bank. Most of its customers are well-heeled Manhattan property developers and other real estate-related businesses. However the bank was relatively unique in that it had built a real-time payments platform, called Signet, that enabled customers to instantly remit funds to other Signature customers on a 24/7 basis. Signet was particularly useful for businesses that trade digital assets, given that digital asset exchanges operate around the clock, and the bank had onboarded many crypto clients in the past couple of years.

Let’s take a look at why the government chose to shut down Signature.

Silvergate: the first domino to fall

On Wednesday 8 March, just four days before Silicon Valley Bank failed and Signature was shut down, San Diego-based Silvergate Bank announced that it would ‘voluntarily’ close after its management confirmed that the bank would be unable to file its annual report on time. Until a decade ago, Silvergate was a little-known regional bank. In 2013 the bank’s management began offering services to crypto businesses; its deposit base boomed and the bank thrived along with the industry (for awhile).

Beginning in late 2021, Silvergate descended into a spiral as the crypto bull market ended and its stock price (NYSE: SI) fell precipitously from an all-time high of $222. Customers began withdrawing funds en masse in the fourth quarter of 2022, when the bank disclosed that 10% of its digital asset deposits had come from failed mega-fraud FTX.

Shares in Silvergate Bank collapsed with the crypto bull market. Source: Trading View

Regulators pounced on the opportunity to chastise Silvergate and other banks for providing services to FTX, and tried their best to distract from the fact that Sam Bankman-Fried had become a darling of the Democratic party by donating $36 million of what later proved to be stolen customer funds. Senator Elizabeth Warren sent a sternly-worded letter to the bank on 6 December 2022, accusing the bank of failing to report suspicious activities associated with FTX.

It is worth pointing out that many politicians also failed to do their due diligence, even as they cashed SBF’s checks. SEC Chairman Gary Gensler, who has repeatedly refused to meet with most US crypto company executives during his tenure, granted a 45-minute Zoom audience to Bankman-Fried in March 2022 - despite the fact that FTX was headquartered in the Bahamas (!!) There is no record of the SEC investigating FTX before its failure.

The one-two punch of FTX-driven losses and customer withdrawals, followed by the regulatory chill from Washington, were Silvergate’s undoing. The bank would be forced to shut down less than two months later.

Next up: Silicon Valley Bank

Less than two days after Silvergate’s failure, in what is perhaps the worst-timed announcement in recent memory, Silicon Valley Bank announced that it had incurred substantial operating losses and would need to raise equity capital.

There is currently no shortage of online discussion regarding who was to blame for SVB’s failure, and there is not much that I can add to the debate. Certainly the bank’s management bears the brunt; their incompetence has proven to be breathtaking on multiple levels. Their failure to manage duration risk – they continued to hold billions of dollars of long-dated bonds even as the Fed embarked on the most aggressive series of rate hikes in 40 years - is ultimately what brought the bank down.

I will just make two points here:

Some have claimed that loud warnings from venture capitalists like Peter Thiel were unnecessary and were the equivalent of shouting ‘fire’ in a crowded theater. The truth is that SVB’s customers had been increasingly concerned about the bank’s health for some time. Union Square Ventures, a renowned investment firm, had warned its portfolio companies to diversify their banking relationships away from SVB as long ago as November 2022.

This bank run also highlights how much the game has changed for today’s banking industry. The advent of mobile banking and proliferation of social media - two trends that barely existed during the last banking crisis - now allow a bank’s customers to collect information and act on it in real time. Most of SVB’s deposits were highly concentrated among a handful of venture capital and private equity clients, who moved $42 billion out of the bank within hours and triggered a cascading demand for withdrawals that drove it into insolvency in less than a day. The banking industry now needs to determine whether their ‘Tier 1’ capital reserves are adequate in this new reality of ‘ultra-hot money’.

Signature: The Feds shut down a solvent bank

Last Friday, when it became clear before the market close that SVB was destined to fail, there was no indication that Signature Bank would suffer a similar fate. Its stock had dropped as much as 50% that day, but there were no endogenous factors attributing to that selloff. As Barney Frank said, the price action was driven by market perceptions of contagion risk from Silvergate and SVB.

Yet over the past three days we have seen mounting evidence that the US government has now weaponized the banking sector to organize a coordinated crackdown against the digital asset industry. Yesterday sources told Reuters that the FDIC, who is seeking a buyer for Signature Bank, would only accept bids from existing banks and “must agree to give up all crypto business.” (This morning the Feds hilariously denied the claim, in the process channeling Groucho Marx and his immortal quote “Who are you gonna believe, me or your lying eyes?”)

Further evidence of the Fed’s hostile stance is contained within its own policy statement from 27 January of this year, when it discouraged banks from holding digital assets and rejected an application from Wyoming-based Custodia Bank to join the Federal Reserve system. Custodia had intended to offer digital asset banking and custody services to its depositors. The Fed’s stated reason for the rejection was that it had “found crypto assets to be at odds with sound banking practices.”

When reviewed in entirety, it is clear that the Biden Administration has decided to cut off the crypto industry’s access to the US banking system. This practice will almost certainly be struck down by a reasonable constitutional challenge, though this will of course take months if not years to pursue.

Unfortunately this practice of coercion against the banks as a regulatory weapon is not a new practice – during the Obama administration, the Department of Justice colluded with the FDIC to threaten banks with regulatory pressure if they did not withhold services to certain industries like gun dealers and other so-called “high risk” businesses. Dubbed ‘Operation Choke Point’, the practice ended with that administration, and is still being litigated in court today. Unfortunately it seems that the Biden administration has revived the tactic and is now deploying ‘Choke Point 2.0’ against the crypto industry.

What Happens Next?

At least one DC lobbying group has already filed a Freedom of Information Act (FOIA) request from the Fed and its parallel agencies to explain why a solvent bank was seized, and whether the decision was driven by a desire to intimidate the banking industry into avoiding crypto. Federal officials are currently stating that the government is not targeting any specific industry. As is always the case in politics, actions speak louder than words.

What is abundantly clear is that the Biden Administration has now declared itself openly hostile to the crypto industry. Yet in the wake of failures of the two most crypto-friendly US banks, prices for digital assets have actually increased. Remarkably, the price of Bitcoin rose 22% last Friday even as the broader regional banking ETF fell by the same amount! Crypto prices are holding steady at the time I wrote this.

More than anything, this demonstrates why the crypto industry is here to stay. Despite the efforts of the world’s most powerful government to shut it down, its flagship asset (Bitcoin) remains the honey badger of global finance and displays an anti-fragility that befits its growing reputation as a store of value. Bitcoin will continue to act as a hedge against corruption and profligacy in the US financial system, and its price will be inversely correlated to the market’s trust in the Federal Reserve.

In other words, Bitcoin is about to move a lot higher.

This is not to say that the crypto industry should not be regulated more actively. I love this community, but it is currently plagued with fraud, and the leaders of many of its companies (Brian Armstrong at Coinbase being a notable positive exception) continue to display a general lack of leadership and maturity. Many of today’s problems can be directly attributed to the crypto community’s failure to police its own ranks. The industry should welcome smarter regulation, but the government’s current actions serve no one.

Finally, US government officials would be wise to remember that today’s world is multi-polar and that both capital and innovation are highly mobile. To its deep chagrin, SVB management just discovered how rapidly its customers can withdraw funds once their trust has been broken. If the US Treasury and accompanying ‘alphabet soup’ of federal agencies continue to treat the crypto industry as a hostile threat, then that community will leave the American economy as quickly as SVB depositors left their bank.