The Obamacare Exit Ramp

How a congressional campaign became a crash course on escape strategies from America’s broken health insurance system.

Earlier this year, I decided to run for Congress in my home state of Iowa. I have no political background, and had not even considered running for office until late December of last year. My last-minute decision to enter the race meant that I had to compress what is normally nine months of campaigning into five.

I mention this for two reasons. First, I hope that this context will persuade my readers to forgive me for the extended break that I took from writing this column. Mostly, though, I mention my campaign because it helped me to better understand some of the most serious problems that Americans face today.

When I first decided to run, I had an opportunity to speak with a serving member of Congress who gave me some great advice. “Whatever happens”, he said, “this experience will change you forever. Take what you learn, win or lose, and use it in any way that you can.”

I have since learned just how good that advice was. My campaign ended in early June when I received 40% of the vote in the Republican primary – highly respectable for a first-time candidate, but not enough to win1. No one likes to lose but I feel incredibly grateful for everything I learned along the way, about the issues that Americans grapple with on a daily basis.

You likely won’t be at all surprised to hear that health insurance is one of those topics. In fact I now believe that there is an unreported crisis among working Americans who are paying more than ever, while receiving less in return. By now everyone has heard heartbreaking stories about people whose lives were ruined by escalating healthcare costs, or a callous insurer’s refusal to provide coverage. Many people feel trapped between government-run Obamacare, with its rising costs and poor service, and deeply flawed employer-sponsored insurance plans.

The good news is that I didn’t just learn about how broken our health insurance industry has become. Today’s column is about the solutions that are out there, if you take the time to find them.

*****************

One meets some fascinating people while campaigning. From the farmer who is giving me a Ph.D-level education on regenerative agriculture, to the lady down the road who knocked on over 1,000 doors on my behalf, it was truly an amazing experience that I will always treasure.

Most politicians are familiar with ‘campaign groupies’ – those people, usually retired, who follow a candidate to many of their events. Groupies are often single-issue voters who want to ensure the candidate is taking their issue seriously. I picked up a few of these along the way, and after awhile I started to jokingly refer to them as the ‘Forrest Gump joggers’ in reference to the people that followed Tom Hanks’ movie character when he was running across America.

One of these groupies was particularly impactful. This gentleman drove to nearly all of my campaign stops in the final two months. He used to sell insurance, and he would always stand up during the Q&A segment at my events and mention how much it cost taxpayers for a local government employee to be on Obamacare.

This man personifies the definition of ‘single-issue voter’. He REALLY hates the Affordable Care Act and the associated fraud and waste that it has wrought upon the American economy. He always had the hard data to back it up too; before visiting each of my campaign stops he would call ahead and ask the local school administrator how much it cost to provide health insurance for a teacher in that town.

Now, health insurance is everybody’s problem but it isn’t exactly a riveting topic for discussion. Most of us are aware, on at least an abstract level, that the costs of today’s health insurance plans are spiraling out of control while those same plans provide ever-worsening outcomes.

But I would watch the other attendees at my events as he recited these numbers, and I could see their eyes glaze over. I must confess that I didn’t focus too intently on what he was saying for the first few interactions, either.

After a bit, though, I started to pay attention. In one session, he mentioned how health insurance for a single mother with a child in the town of Ames cost over $27,000 per year. He pointed out that taxpayers cover most of this bill – even if the mother becomes too sick to work. But if the mother were to be injured or diagnosed with a chronic disease then she would likely be cut off from her subsidized insurance after just three months, and forced to pay the full $27,000 out of pocket - plus a 2% administrative fee that adds insult to injury.

This caught my attention. After all, I thought, wasn’t the entire point of insurance to protect against life-changing and catastrophic events? It made no sense that coverage could cost so much, and yet the insured might lose that protection when they need it most. I resolved to prove him wrong.

I checked later that evening and he was accurate, down to the penny2. I was dumbstruck – how could a government employer possibly charge that much money for health insurance, yet cut off an employee if her condition prevented her from working?

And more importantly, I wondered, why should anyone use their employer’s health insurance if they run the risk of being dropped in their hour of need?

So began my journey down the rabbit hole.

***********

It has now been just over three months since my campaign ended. I have used the ensuing time to learn as much as I can about the health insurance market and I am still trying to wrap my head around the sheer scale of corruption and mismanagement.

Here are just a few of the things that I have learned, and will be writing about in the near future:

I learned that most government-run health insurance plans are garbage. There are very few PPOs left on the market - instead, most Obamacare plans are low-quality HMOs that rarely if ever provide access to the country’s best hospitals like the Mayo Clinic or MD Anderson in Texas. For example, the Mayo Clinic is a short drive away for most Iowans, but there is not a single ACA plan in Iowa that provides in-network access. Nor is MD Anderson - the world’s best cancer hospital – considered in-network for Obamacare plans in Texas.3

I learned about companies like Centene, the most corrupt company that you have likely never heard of. Centene is a mammoth $40 billion company that trades on the New York Stock Exchange, and is the largest provider of government insurance plans. It is also the defendant in a multi-billion dollar RICO lawsuit that spans 26 states, and is under federal investigation for failing to provide basic medical services to vulnerable foster children in Chicago.45

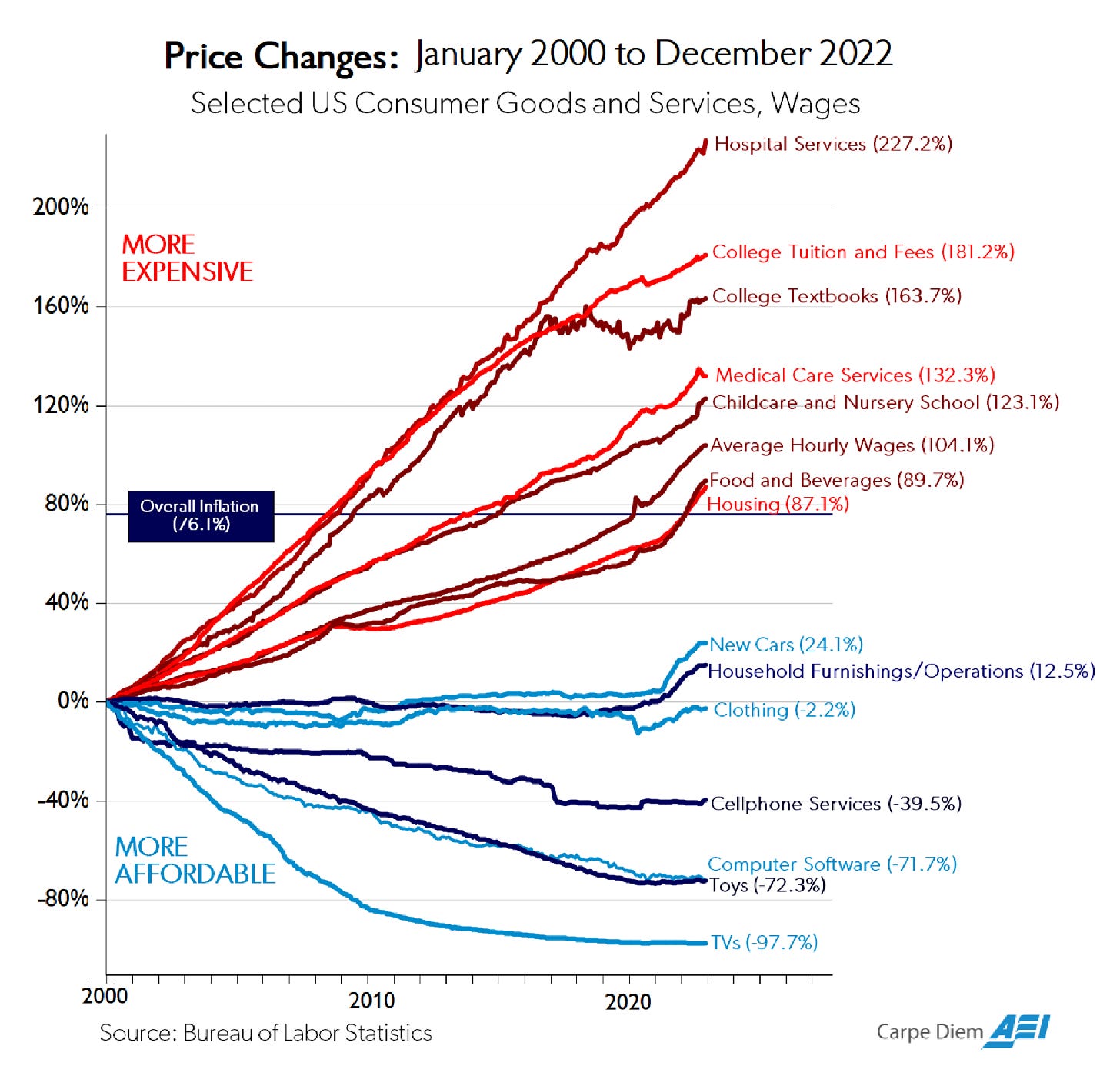

I learned that hospital expenses have been the fastest-growing line item in the American economy since Obamacare took effect – up a whopping 227% since 2000. The only other expense that comes close is college tuition (181% in the same time period).6

The sad truth is that, under the ironically-named Affordable Care Act, neither health care nor health coverage has been affordable. Many of the government’s policies, such as dictating to insurers what should and should not be covered, have been counterproductive. Excessive regulation has stifled competition, raised prices and lowered the quality of coverage.

Healthcare in America has become an absolute disaster that now consumes $4.5 trillion every year.7 Put another way, it consumes one-fifth of our national GDP. To make matters worse, recent studies indicate that one-quarter of that expenditure – over a trillion dollars – is wasted on ineffective and even harmful initiatives.8

While campaigning, I talked to countless people who were undergoing severe financial distress. Most of them were more stressed about losing their jobs – not so much the loss of income, but the loss of health insurance coverage for their families. And yet the quality of health insurance declines every year as Obamacare policies continue to offer less while charging them and the taxpayer more.

If you’re not already depressed, here are some more statistics that should finish the job:

In 2021, health care spending was 18.3% of America’s GDP. That is 38% higher than the 13.3% of GDP that we expended in 2000. So much for ‘Affordable Care’.

Recent government audits confirm that there is significant waste in the health care sector, with some estimates suggesting that up to a quarter of health care spending provides people with little, if any, health benefit.

American life expectancy was lower in 2019 (a pre-pandemic measure) than it was in 2013, before the ACA’s coverage and spending provisions took effect.9

Probably nothing has contributed to the decline of the American consumer than our healthcare system, and the health insurance market is one of the worst offenders. This is why few American institutions are hated more than the large insurance carriers.

************

Our healthcare establishment wants us to believe that we are moving inexorably toward what they like to call a ‘single-payer system’. This term is really just a euphemism for ‘socialized health care’ where the free market doesn’t exist and the government controls how money is spent, and how many resources are allocated to each of us.

There are three heads to this hydra that I define as the ‘establishment’:

The mega-corporations that interact directly with federal and state governments, and use their massive balance sheets to control influential politicians

The federal government. In this case, political parties are irrelevant; when it comes to Obamacare, career Republican politicians are now indistinguishable from Democrats. The healthcare industry is by far the largest spender on lobbying of any industry.

The corporate media, which the corporations do of course control.

The establishment doesn’t spend billions on advertising and public relations to drive sales – that money is used to coerce the media into silence and to deter any would-be journalists from asking hard questions about the industry’s practices or exorbitant government contracts.

A great example is during the COVID response when the pharma industry paid for as much as 75% of ALL television advertising.10 The return on their ‘investment’ is enormous, since it enables the industry to absorb hundreds of billions of dollars from the government in no-bid contracts and favorable policy.

In return, we the people receive progressively worse health care every year – even as our premiums and deductibles rise.

***********

This is where we begin to focus on the positives.

Most of us are conditioned to believe that we only have two options when it comes to health insurance. If we are employed, we can sign up for coverage that our employer provides. If not, then our only recourse is through government-run (Obamacare) plans.

Premiums and deductibles for Obamacare are climbing to unsustainable levels, even as coverage quality drops. And there are many reasons why you should think twice about using your employer’s health insurance - which will be the topic of a future article.

During my campaign I was surprised to hear about the existence of a third health insurance option – that is, plans provided through the free market by well-known carriers like Allstate and UnitedHealthCare. These are plans that are tied to the individual and not to that individual’s employer.

Following is a quick summary of some plans that I find very interesting. Again, I will write more about each of these policy types in a future article:

Short-Term Health Insurance

I like to refer to these short-term plans as ‘the Trump PPO’ because after his unsuccessful attempt to repeal the ACA, President Trump issued an executive order in 2018 that created the possibility of short-term plans as a free-market alternative to Obamacare.11 I had never heard of short-term plans until my campaign, and most of you probably haven’t either.

It is important to note that the Biden Administration is doing everything it can to kill short-term plans because they compete with those plans offered by the ACA. Earlier this month Biden issued an executive order (which will likely be found unconstitutional) that limits their duration.12 For now they are still available albeit with many constraints.

The medical establishment wants you to believe that these free-market alternatives to Obamacare are ‘junk insurance’ because they don’t protect against pre-existing conditions. It’s true that they don’t – but if you and your loved ones are relatively healthy, then short-term plans are an amazing way to protect against the worst-case scenarios like a cancer diagnosis or a grievous injury, and they are usually offered at a substantial discount when compared to overpriced Obamacare plans.

Short-term plans are also tied to the insured and not to their employer, so you don’t run the risk of your premiums rising through the roof or even losing coverage altogether if you get sick and can’t work. They are ‘short-term’ in duration, but you are free to renew coverage (this has recently become more difficult as the Biden Administration has attempted to shut them down, but it is still legally possible to do so.)

Unlike most Obamacare plans, which are lousy HMOs with thin coverage networks, most short-term plans are high-quality PPOs that convey access to the nationwide Aetna and/or Cigna networks with thousands of providers – and yes, the Mayo Clinic and MD Anderson are included.

Fixed Indemnity Health Insurance

You may recognize fixed indemnity plans from the famous AFLAC ads with the talking duck. These plans are offered on the free market, are tied to the insured, and make a cash payment to the insured in the event of a covered event like a hospitalization.

Obamacare policies require the insured to share costs with the government up to a pre-determined maximum. In 2025 that maximum will be $9,200. That’s the amount you would need to pay out of pocket in the event you or anyone on your policy incurred significant medical expenses.

The average hospital stay in America is 4.5 days, and the average daily cost for a hospital stay is $2,883.13 This implies that on average, a hospital visit in America will cost $12,974. If you are unlucky next year, and run up a hospital bill of that magnitude, you will pay out your deductible immediately and may be on the hook for thousands of dollars within a week.

Now imagine that you had a policy that paid you up to $3,000 per day in the event you were hospitalized. That’s what a fixed indemnity plan does.

If insurance is meant to guard against the worst-case scenario, then a fixed indemnity plan should be part of your family’s protection.

Health Savings Accounts

For the life of me I cannot understand why HSAs don’t get more coverage in financial media. Many financial advisors believe that the HSA is an even more powerful tax savings and retirement tool than the individual retirement account (IRA).

Health savings accounts (HSAs) allow people to pay for qualified medical expenses with pre-tax dollars. Currently, they are only available for people with high-deductible health plans (HDHPs) as defined by the IRS (see chart below).

Like IRAs, the HSA is a savings account that you can fund with pretax dollars and then invest in anything that you are permitted to invest in with your IRA. That means individual stocks, ETFs, mutual funds, or other approved securities. Like an IRA, your returns grow tax-free.

Many people confuse HSAs with flexible spending accounts (FSAs) but there is one critical difference: money contributed to FSAs in a given year must be spent in that year or lost forever, while HSA funds can be used to pay for qualified healthcare expenses now – or let that balance build and use it in retirement.

HSAs aren’t currently available to everyone – though I strongly believe that they should be. Currently you must be on a so-called ‘high deductible health plan’ in order to qualify. Read this WSJ article to learn more.14

****************

Plans offered on the free market will not be suitable for everyone. If you or a family member have health problems (the so-called ‘pre-existing condition’) then they probably aren’t for you. But if you’re healthy then they are a great way to use insurance in the way that it was actually intended – as financial protection against catastrophe. They can also save you hundreds and possibly thousands of dollars every month because you’re not subscribing to a plan that includes coverage for basic services that you won’t need, and hopefully never will.

I often think about how much time and effort people spend on financial planning for their retirement. An entire industry of advisors exist for this purpose, and yet when it comes to planning for their health most people are content to outsource their insurance needs to the government or to their employer.

I believe that, as Americans increasingly conclude that their government is incapable of providing for their needs, many people will choose to be self-reliant and seek solutions in the free market. Everyone has unique needs and therefore they will need to build an insurance protection plan that suits those needs – just like their investment portfolio.

My hope and intent is to become a resource for people who wish to become more self-reliant and learn about available solutions that can save them money and provide better protection for themselves and their families.

****************

This was a difficult article for me to write. The American healthcare system is so utterly broken that any attempt to condense this problem, and to offer solutions, into a single article is a Herculean task.

But the time for solutions is here. The federal government has by now made it clear that it cannot be counted on to offer any, so it is up to each of us as individuals to find our own. I believe that, as more Americans reach the conclusion that our government is staggeringly incompetent and unable to provide even basic services to us, that we must create our own.

Free-market solutions are nearly always superior to government-run alternatives. This rings particularly true with health insurance, and I am grateful to my ‘campaign groupies’ for teaching me.

I intend to write much more on this topic in the coming weeks, and hope that you will come along for the ride.

https://www.nytimes.com/interactive/2024/06/04/us/elections/results-iowa-us-house-4-primary.html

https://www.inside.iastate.edu/article/2022/09/29/premiums#:~:text=Multiyear%20strategy,in%20PPO%20premiums%20next%20year.

https://www.mdanderson.org/patients-family/becoming-our-patient/planning-for-care/insurance-billing-financial-support/insurance-plans.html

https://www.prweb.com/releases/landmark-ruling-in-rico-lawsuit-against-centene-corporation-alleging-the-company-defrauds-consumers-through-sale-of-its-ambetter-health-insurance-plans-302136329.html

https://chicago.suntimes.com/2022/11/11/23451889/centene-corp-youthcare-illinois-foster-care-medicaid

https://paragoninstitute.org/public-health/why-healthcare-unaffordable/

https://www.medicaleconomics.com/view/u-s-health-care-spending-hits-4-5-trillion-in-2022

https://pubmed.ncbi.nlm.nih.gov/31589283/

https://www.macrotrends.net/global-metrics/countries/USA/united-states/life-expectancy

https://www.statista.com/statistics/953104/pharma-industry-tv-ad-spend-us/#:~:text=In%202020%2C%20the%20pharmaceutical%20industry,of%20the%20total%20ad%20spend.

https://www.cms.gov/newsroom/press-releases/hhs-news-release-trump-administration-delivers-promise-more-affordable-health-insurance-options

https://nationalhealthcouncil.org/blog/biden-administration-addresses-short-term-health-plans/

https://www.kff.org/health-costs/state-indicator/expenses-per-inpatient-day/?currentTimeframe=0&sortModel=%7B%22colId%22:%22Location%22,%22sort%22:%22asc%22%7D

https://www.wsj.com/buyside/personal-finance/investing/what-is-an-hsa